Home and Auto Insurance Bundle Quotes Explained sets the stage for this informative journey, offering readers a detailed look into the world of bundled insurance with a mix of casual formal language style.

As we delve into the intricacies of home and auto insurance bundles, readers will gain a deeper understanding of how to navigate this essential aspect of insurance planning.

Overview of Home and Auto Insurance Bundle Quotes

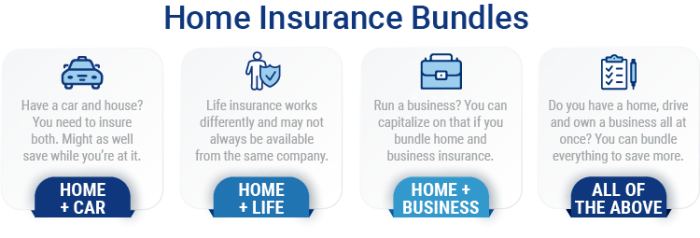

When you bundle home and auto insurance, you are combining both policies into one package offered by the same insurance company. This means you will have one insurance provider for both your home and auto coverage.

There are several benefits to bundling home and auto insurance. One of the main advantages is the potential cost savings. Insurance companies often offer discounts when you bundle multiple policies with them. This can result in lower premiums compared to purchasing separate policies from different providers.

Reasons Why Bundling Home and Auto Insurance is Beneficial

- Cost Savings: Bundling home and auto insurance can lead to discounted premiums, saving you money in the long run.

- Convenience: Having both policies with the same insurance company can make it easier to manage your coverage and payments.

- Additional Discounts: Some insurance companies may offer additional discounts or perks for bundling multiple policies with them.

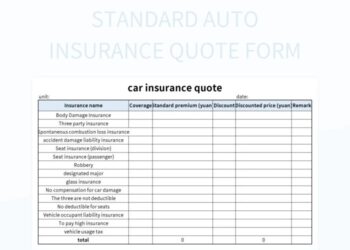

How Insurance Companies Calculate Bundle Quotes

Insurance companies take various factors into account when calculating bundle quotes for home and auto insurance. These factors can include:

- Age, location, and driving history for auto insurance

- Home value, location, and details about the property for home insurance

- Claims history and credit score

Factors Influencing Bundle Quotes

When it comes to determining home and auto insurance bundle quotes, several key factors come into play that can significantly impact the overall cost of the insurance package. These factors include the location of the insured property, policy limits, deductibles, and more.

Location of the Insured Property

The location of the insured property plays a crucial role in determining the cost of a bundled insurance policy. Insurance companies assess the risk associated with the location of the property, considering factors such as crime rates, weather patterns, and proximity to natural disaster-prone areas.

Properties located in high-crime areas or regions prone to severe weather conditions may result in higher insurance premiums.

Role of Policy Limits and Deductibles

Policy limits and deductibles also play a significant role in influencing bundle insurance quotes. Policy limits refer to the maximum amount an insurance company will pay out in the event of a claim. Higher policy limits typically result in higher premiums.

On the other hand, deductibles represent the amount the policyholder is required to pay out of pocket before the insurance coverage kicks in. Opting for lower deductibles may lead to higher premiums, while choosing higher deductibles can help lower the overall cost of the insurance bundle.

Comparing Bundle Quotes from Different Providers

When it comes to comparing home and auto insurance bundle quotes from different providers, it's essential to consider a few key factors to make an informed decision. Here's a breakdown of the process and tips to help you effectively compare quotes from various insurance companies.

Understanding the Process

- Request Quotes: Start by obtaining bundle quotes from different insurance providers. You can do this online, over the phone, or by visiting their offices.

- Review Coverage Options: Examine the coverage options included in each bundle quote to ensure they meet your specific needs for both home and auto insurance.

- Compare Premiums: Look at the total cost of the bundle quotes, considering both the monthly or annual premiums for both home and auto insurance policies.

- Check Discounts: Inquire about any discounts or special offers that each provider may offer for bundling your home and auto insurance policies together.

Tips for Effective Comparison

- Compare Apples to Apples: Make sure you're comparing similar coverage levels and deductibles when evaluating bundle quotes from different providers.

- Consider Customer Service: Look into the reputation of each insurance company for customer service and claims processing to ensure you'll receive the support you need.

- Read Reviews: Take the time to read reviews and testimonials from other policyholders to get a sense of the overall customer experience with each provider.

- Ask Questions: Don't hesitate to contact each insurance company directly to ask any questions you may have about their bundle quotes or coverage options.

Importance of Coverage Options and Customer Service

- Choosing the Right Coverage: It's crucial to select a bundle quote that offers the right coverage for your home and auto insurance needs, even if it means paying a slightly higher premium.

- Quality Customer Service: Opting for an insurance provider known for excellent customer service can save you time and frustration when dealing with claims or policy-related inquiries.

- Peace of Mind: Knowing you have comprehensive coverage and reliable customer support can provide peace of mind and confidence in your insurance decisions.

Customizing Bundle Quotes to Fit Individual Needs

When it comes to home and auto insurance bundle quotes, policyholders have the flexibility to customize their coverage to meet their specific needs. By adding on certain endorsements or adjusting coverage limits, individuals can tailor their insurance bundle to provide the protection they require.

Add-Ons and Endorsements for Bundled Policies

- Enhanced Liability Coverage: Policyholders can increase their liability limits to ensure they are adequately protected in case of a lawsuit or legal claim.

- Roadside Assistance: Including roadside assistance in a bundled policy can provide peace of mind for drivers facing unexpected breakdowns or emergencies.

- Rental Car Reimbursement: This add-on covers the cost of a rental car if the insured vehicle is in the shop for repairs after an accident.

- Identity Theft Protection: Adding identity theft protection can help policyholders recover from the financial and emotional impact of identity theft.

Importance of Regularly Reviewing Bundle Quotes

It is crucial for policyholders to review and update their bundle quotes regularly to ensure they have adequate coverage. Life circumstances, such as buying a new home or acquiring a new car, can impact insurance needs. By reviewing their bundle quotes annually or after significant life events, individuals can make sure they are appropriately protected.

End of Discussion

In conclusion, Home and Auto Insurance Bundle Quotes Explained sheds light on the complexities of bundling insurance policies, empowering readers to make informed decisions when securing their valuable assets.

FAQ Section

What factors influence home and auto insurance bundle quotes?

Factors such as location, policy limits, and deductibles can impact the cost of bundled insurance.

How can policyholders customize their bundle quotes?

Policyholders can customize their quotes by adding specific endorsements or reviewing coverage options regularly.

![The [Ultimate 2025 Guide] To Public Liability Insurance In Dubai](https://consul.infotangerang.id/wp-content/uploads/2025/11/New-Rules-for-Premium-Payments-in-Insurance-75x75.png)

![The [Ultimate 2025 Guide] To Public Liability Insurance In Dubai](https://consul.infotangerang.id/wp-content/uploads/2025/11/New-Rules-for-Premium-Payments-in-Insurance-120x86.png)