Beginning with Shop for Auto Insurance: The Ultimate 2025 Guide, this introductory paragraph aims to grab the readers' attention and provide a brief overview of what to expect in the upcoming content.

The following paragraph will delve into the intricate details and insights about the evolution of auto insurance and the key trends shaping the industry by 2025.

Overview of Auto Insurance in 2025

![The [Ultimate 2025 Guide] To Public Liability Insurance In Dubai The [Ultimate 2025 Guide] To Public Liability Insurance In Dubai](https://consul.infotangerang.id/wp-content/uploads/2025/11/New-Rules-for-Premium-Payments-in-Insurance.png)

Auto insurance has undergone significant evolution in recent years, adapting to the changing needs of consumers and advancements in technology. As we look towards 2025, several key trends and changes are shaping the auto insurance industry, influencing policies and coverage options for drivers.

Evolution of Auto Insurance

- Historically, auto insurance has been a mandatory requirement for drivers to protect themselves and others in case of accidents.

- Over the years, insurance companies have introduced new products and services to cater to the diverse needs of drivers, such as comprehensive coverage, roadside assistance, and telematics-based policies.

- The rise of digital platforms and Insurtech companies has revolutionized the way insurance is bought and sold, making it more accessible and convenient for consumers.

Current Trends in 2025

- Usage-based insurance: With advancements in telematics technology, more insurers are offering usage-based policies that base premiums on actual driving behavior.

- Personalized policies: Insurers are leveraging data analytics to tailor policies to individual driver profiles, offering more customized coverage options.

- Focus on sustainability: Many insurance companies are incorporating eco-friendly initiatives and incentives for drivers with environmentally-friendly vehicles.

Key Factors Influencing Auto Insurance Policies

- Technological advancements: The integration of AI, IoT, and blockchain technology is transforming claims processing, fraud detection, and risk assessment in the insurance industry.

- Regulatory changes: Shifts in regulations and compliance requirements are impacting how auto insurance policies are structured and priced.

- Consumer behavior: Changing preferences and expectations of consumers are driving insurers to innovate and offer more transparent and flexible policies.

Importance of Shopping for Auto Insurance

When it comes to auto insurance, shopping around is crucial for finding the best coverage and saving money in the long run. By comparing different policies, individuals can ensure they are getting the most value out of their insurance plans.

Significance of Comparing Auto Insurance Policies

It's essential to compare auto insurance policies from different providers to determine the coverage options, premiums, and discounts available. This allows individuals to make an informed decision based on their specific needs and budget.

How Shopping Around Can Help Find the Best Coverage

By exploring various insurance options, individuals can find the policy that offers the most comprehensive coverage at a competitive price. This ensures that they are adequately protected in the event of an accident or other unforeseen circumstances.

Benefits of Regularly Reviewing and Updating Auto Insurance Policies

Regularly reviewing and updating auto insurance policies is essential to ensure that they align with any changes in the individual's driving habits, vehicle usage, or financial situation. This practice can help optimize coverage and potentially save money by removing unnecessary add-ons or adjusting deductibles.

Factors to Consider When Shopping for Auto Insurance

When shopping for auto insurance in 2025, there are several key factors to consider to ensure you are getting the best coverage at the most competitive rates.

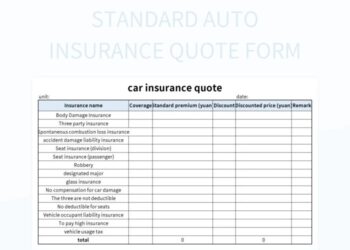

Types of Coverage Available in 2025

- Liability Coverage: This type of coverage helps pay for the other party's damages if you are at fault in an accident.

- Collision Coverage: This coverage helps pay for repairs to your vehicle in the event of a collision.

- Comprehensive Coverage: This coverage helps pay for damages to your vehicle not caused by a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage helps protect you if you are in an accident with a driver who has insufficient insurance.

Cost Factors of Various Auto Insurance Policies

- Age and Driving Record: Younger drivers and those with a history of accidents or violations may pay higher premiums.

- Vehicle Type: The make and model of your vehicle can impact your insurance rates.

- Location: Where you live and park your car can affect your insurance costs.

- Coverage Limits: The amount of coverage you choose will impact your premiums.

Assessing Deductibles and Premiums for Optimal Coverage

- Higher Deductibles: Opting for a higher deductible can lower your premiums, but you will pay more out of pocket in the event of a claim.

- Reviewing Premiums Annually: It's essential to review your policy annually to ensure you are still getting the best rates and coverage based on your changing circumstances.

- Comparing Quotes: Obtain quotes from multiple insurers to compare rates and coverage options before making a decision.

Utilizing Technology for Auto Insurance Shopping

With advancements in technology, the auto insurance shopping experience has been greatly enhanced through the use of AI and data analytics. These technologies have revolutionized the way consumers compare quotes and choose the best coverage for their needs.

Impact of AI and Data Analytics

AI and data analytics play a crucial role in auto insurance shopping by providing personalized recommendations based on individual driving habits and risk factors. These technologies analyze vast amounts of data to accurately assess a driver's profile and suggest the most suitable insurance options.

Role of Insurtech Companies

Insurtech companies have been at the forefront of revolutionizing the insurance industry by leveraging technology to streamline processes and offer innovative solutions. These companies utilize cutting-edge tools to provide customers with a seamless and efficient insurance shopping experience.

Simplifying Comparison with Online Platforms

- Online platforms have simplified the process of comparing auto insurance quotes by allowing consumers to easily input their information and receive multiple quotes from different providers.

- These platforms use algorithms to quickly generate personalized quotes based on the user's driving history, vehicle type, and coverage preferences.

- By utilizing online platforms, consumers can save time and effort in comparing quotes, ultimately enabling them to make informed decisions about their auto insurance coverage.

Closing Notes

Concluding our discussion on Shop for Auto Insurance: The Ultimate 2025 Guide, this final paragraph wraps up the key points discussed and leaves readers with a memorable takeaway about navigating the auto insurance landscape in the future.

Clarifying Questions

What are some new technologies shaping auto insurance in 2025?

AI and data analytics are revolutionizing the auto insurance industry, providing more personalized and efficient services to customers.

How often should I review my auto insurance policy?

It's advisable to review your policy annually to ensure you have adequate coverage and are taking advantage of any new discounts or offers.

![The [Ultimate 2025 Guide] To Public Liability Insurance In Dubai](https://consul.infotangerang.id/wp-content/uploads/2025/11/New-Rules-for-Premium-Payments-in-Insurance-700x375.png)

![The [Ultimate 2025 Guide] To Public Liability Insurance In Dubai](https://consul.infotangerang.id/wp-content/uploads/2025/11/New-Rules-for-Premium-Payments-in-Insurance-120x86.png)