Delving into Auto Insurance Quotation Tips for First-Time Buyers and the Role of Wellness in Achieving Financial Stability, this introduction immerses readers in a unique and compelling narrative. It provides an overview of factors influencing auto insurance quotes and the impact of wellness on financial stability.

It further explores coverage options for first-time buyers, the process of obtaining quotes, and tips for estimating coverage needs accurately. Additionally, it delves into how physical and mental wellness can affect financial well-being, offering strategies for managing stress and making better financial decisions.

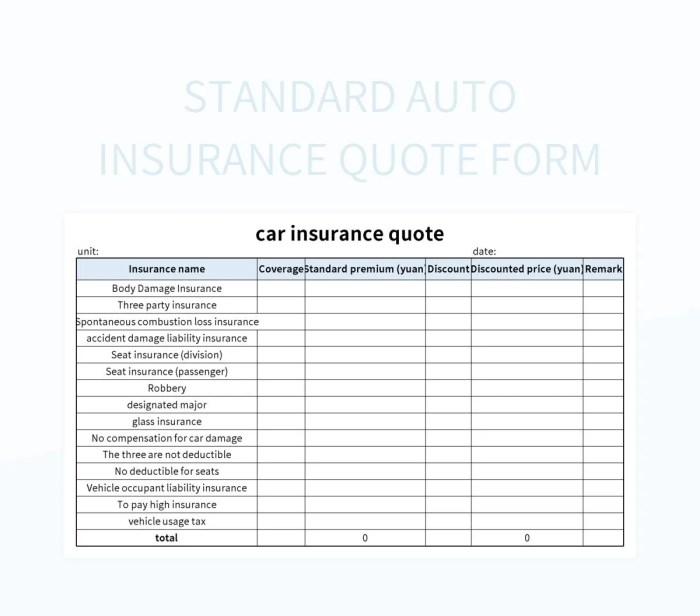

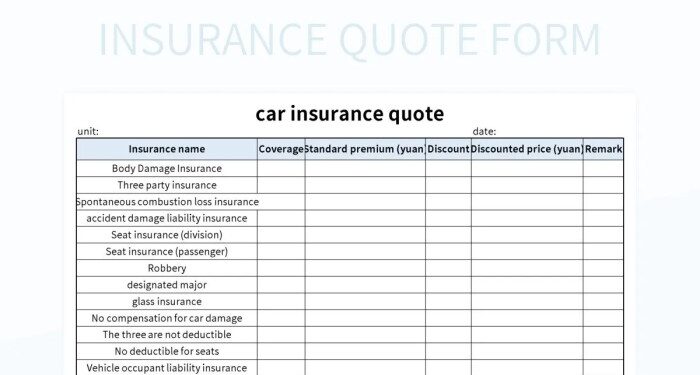

Auto Insurance Quotation Tips for First-Time Buyers

When it comes to purchasing auto insurance for the first time, there are several important factors to consider in order to get the best coverage at the right price. Understanding the key elements that influence auto insurance quotes can help first-time buyers make informed decisions.

Factors that Influence Auto Insurance Quotes

- Driving record: A clean driving record with no accidents or traffic violations typically leads to lower insurance premiums.

- Age and experience: Younger and inexperienced drivers often face higher insurance rates due to a higher risk of accidents.

- Type of vehicle: The make, model, and age of the vehicle can impact insurance costs, with newer and more expensive cars usually requiring higher coverage.

- Location: Where you live and where you park your car can affect insurance rates, especially in areas with high rates of theft or accidents.

Types of Coverage Options Available for First-Time Buyers

- Liability coverage: Protects you in case you are at fault in an accident and covers the other party's medical expenses and property damage.

- Collision coverage: Pays for damages to your own vehicle in the event of a collision, regardless of fault.

- Comprehensive coverage: Covers damages to your vehicle from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: Protects you if you are in an accident with a driver who lacks insurance or sufficient coverage.

Comparing Quotes from Multiple Insurance Providers

- Request quotes from at least three different insurance companies to compare prices and coverage options.

- Consider additional benefits or discounts offered by each provider, such as safe driver discounts or bundling policies.

- Review the details of each quote carefully, including deductibles, coverage limits, and any exclusions.

Tips on How to Accurately Estimate Coverage Needs

- Assess your driving habits and risks to determine the appropriate level of coverage for your situation.

- Consider the value of your vehicle and your financial assets to ensure you have adequate liability coverage.

- Consult with an insurance agent or use online tools to calculate the recommended coverage based on your individual circumstances.

The Role of Wellness in Achieving Financial Stability

Physical and mental wellness play a crucial role in achieving financial stability. When individuals are in good physical health, they are more likely to be able to work consistently and earn a steady income. On the other hand, mental health impacts decision-making abilities and can influence financial behaviors.

Physical Wellness and Financial Stability

Maintaining physical wellness through regular exercise and healthy eating habits can reduce healthcare expenses and increase productivity at work. This can lead to higher income levels and better financial stability overall.

- Regular exercise can boost energy levels and improve focus, leading to increased efficiency at work.

- A healthy diet can prevent costly medical conditions and reduce the financial burden of healthcare expenses.

- Physical wellness can also contribute to better sleep quality, reducing the risk of absenteeism and improving overall performance.

Mental Health and Financial Well-being

Mental health plays a significant role in financial well-being as it affects decision-making processes, risk tolerance, and overall financial behavior. Strategies to improve mental health can positively impact financial stability.

- Practicing mindfulness and stress management techniques can reduce impulsive financial decisions and promote better financial planning.

- Seeking professional help when needed can prevent financial crises caused by mental health issues such as anxiety or depression.

- Building a support system of friends and family can provide emotional stability, leading to better financial decision-making.

Designing a Wellness Plan with Financial Goals

Integrating financial goals into a wellness plan can create a holistic approach to overall well-being. Setting specific financial targets and incorporating them into daily wellness routines can lead to long-term financial stability.

- Creating a budget that aligns with wellness goals, such as investing in healthy food options or gym memberships.

- Setting aside emergency savings for unexpected healthcare costs or mental health services.

- Tracking financial progress alongside physical and mental health improvements to maintain motivation and consistency.

Strategies for Managing Stress and Improving Financial Decision-making

Managing stress is essential for making sound financial decisions. Implementing strategies to reduce stress levels and enhance decision-making abilities can lead to better financial outcomes in the long run.

- Practicing relaxation techniques such as deep breathing or meditation to calm the mind before making financial decisions.

- Setting realistic financial goals and breaking them down into manageable steps to avoid feeling overwhelmed.

- Seeking financial education and advice to make informed decisions and avoid impulsive choices based on stress or anxiety.

Final Thoughts

In conclusion, understanding Auto Insurance Quotation Tips for First-Time Buyers and the Role of Wellness in Achieving Financial Stability is crucial for making informed decisions. By applying these tips and focusing on wellness, individuals can work towards a more secure financial future.

Essential Questionnaire

What factors influence auto insurance quotes?

Auto insurance quotes are influenced by factors such as age, driving record, type of vehicle, and location. Insurers also consider credit history and coverage options when determining rates.

How can first-time buyers accurately estimate their coverage needs?

First-time buyers can accurately estimate coverage needs by considering factors like the value of their vehicle, potential risks, and state requirements. Consulting with an insurance agent can also help determine appropriate coverage levels.

![The [Ultimate 2025 Guide] To Public Liability Insurance In Dubai](https://consul.infotangerang.id/wp-content/uploads/2025/11/New-Rules-for-Premium-Payments-in-Insurance-120x86.png)