Auto Policy Quotes: How to Compare Like a Pro sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Understanding auto policy quotes involves unraveling the intricate details that shape insurance premiums, from key components to coverage levels.

Understanding Auto Policy Quotes

When it comes to auto insurance, understanding policy quotes is essential for making informed decisions. Let's break down the key components and factors that influence these quotes.

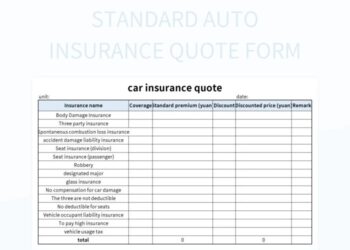

Key Components of an Auto Policy Quote

- The premium: This is the amount you pay for the insurance policy, typically on a monthly or annual basis.

- Deductible: The amount you agree to pay out of pocket before your insurance kicks in to cover the rest.

- Coverage limits: The maximum amount your insurance will pay out for a covered claim.

- Types of coverage: This includes liability, collision, comprehensive, uninsured/underinsured motorist, and more.

Factors Influencing Auto Policy Quotes

- Driving record: A history of accidents or traffic violations can increase your premium.

- Age and gender: Younger drivers and males tend to pay higher premiums due to statistical risk factors.

- Location: Where you live can impact your rates based on crime rates, weather-related risks, and traffic patterns.

- Type of vehicle: The make, model, and age of your car can affect your insurance costs.

Impact of Coverage Levels on Auto Policy Quotes

- Higher coverage limits typically result in higher premiums, but provide more financial protection in case of an accident.

- Adding optional coverages like rental car reimbursement or roadside assistance can increase your premium but offer added peace of mind.

- Choosing a higher deductible can lower your premium, but you'll pay more out of pocket in the event of a claim.

Comparing Auto Policy Quotes

When it comes to choosing the right auto insurance policy, comparing quotes is essential to ensure you get the best coverage at the most competitive price. Here is a step-by-step guide on how to compare auto policy quotes effectively.

Importance of Comparing Coverage Limits

- Check the coverage limits: Make sure to compare the coverage limits offered by different insurance companies. This includes liability coverage, comprehensive coverage, collision coverage, and any additional coverage options.

- Consider your needs: Evaluate your specific insurance needs and ensure that the policy you choose provides adequate coverage for your vehicle and personal assets.

- Understand the deductibles: Compare the deductibles for each coverage type as they can impact your out-of-pocket expenses in the event of a claim.

Tips for Accurate Comparison

- Request the same coverage options: To accurately compare auto policy quotes, make sure you request the same coverage options from each insurance company.

- Provide accurate information: When obtaining quotes, ensure that you provide accurate information about your driving record, vehicle, and personal details to get an accurate quote.

- Review discounts: Inquire about available discounts from each insurance provider to see if you qualify for any savings that could make a policy more affordable.

Utilizing Online Tools for Comparison

When it comes to comparing auto policy quotes, utilizing online tools can offer numerous benefits. These tools provide convenience, speed, and the ability to easily explore multiple options all in one place.

Popular Websites for Auto Policy Quote Comparison

- Insurance.com

- The Zebra

- Compare.com

- Insurify

Inputting Accurate Information for Precise Comparisons

For the most precise quote comparisons, it is crucial to input accurate information into online tools. Make sure to have details like your driving history, the type of coverage you need, and any discounts you may qualify for on hand.

Providing incorrect or incomplete information could lead to inaccurate quotes.

Understanding Fine Print and Exclusions

When obtaining auto policy quotes, it is crucial to not only focus on the premium cost but also to pay close attention to the fine print and exclusions within the policy. Understanding these details can help avoid surprises and ensure you are adequately covered in case of an accident or other unforeseen events.

Importance of Reading the Fine Print

Reading the fine print in auto policy quotes is essential to fully grasp the coverage and limitations of the policy. This includes details on deductibles, coverage limits, and any conditions that may impact your ability to make a claim.

Common Exclusions in Auto Policies

Auto policies often contain exclusions that specify situations or types of damage that are not covered by the policy. Some common exclusions include:

- Intentional damage or illegal activities

- Racing or using the vehicle for hire

- Wear and tear or mechanical breakdown

- Damage from natural disasters like floods or earthquakes

Examples of Exclusions Impacting Quotes

For example, if your policy excludes coverage for racing or using the vehicle for hire, but you engage in these activities, you may face higher premiums or be denied coverage altogether. Similarly, if your policy excludes coverage for natural disasters and you live in an area prone to floods, you may need to seek additional coverage to protect your vehicle.

Concluding Remarks

In conclusion, mastering the art of comparing auto policy quotes like a pro requires attention to detail, thorough analysis, and a keen eye for nuances that can significantly impact your insurance choices.

Key Questions Answered

What factors influence auto policy quotes?

Auto policy quotes are influenced by various factors such as driving record, age, type of vehicle, and coverage level.

Why is it important to compare coverage limits when evaluating auto policy quotes?

Comparing coverage limits helps ensure that you are getting adequate protection for your needs and not just focusing on the price.

How can online tools help in comparing auto policy quotes?

Online tools simplify the comparison process by providing multiple quotes at once, making it easier to see the differences in coverage and cost.

What are common exclusions in auto policies that can affect quotes?

Common exclusions include pre-existing damage, intentional acts, and certain types of modifications not covered by the policy.

![The [Ultimate 2025 Guide] To Public Liability Insurance In Dubai](https://consul.infotangerang.id/wp-content/uploads/2025/11/New-Rules-for-Premium-Payments-in-Insurance-120x86.png)