Exploring the realm of Full Coverage Insurance Quotes: What You Should Know opens up a world of crucial information for car owners. Dive into the details to uncover valuable insights and tips that can guide you towards making informed decisions about your insurance coverage.

Importance of Full Coverage Insurance

Full coverage insurance is essential for car owners as it provides comprehensive protection in various situations.

Benefits of Full Coverage Insurance

- Full coverage insurance typically includes both liability coverage and coverage for damage to your own vehicle, providing financial protection in case of accidents, theft, or natural disasters.

- It can help cover the cost of repairs or replacement of your car, medical expenses for you and your passengers, and legal expenses if you are sued.

- Full coverage insurance can also offer peace of mind knowing that you are adequately protected in any unforeseen circumstances.

Difference Between Full Coverage and Liability-Only Insurance

Full coverage insurance differs from liability-only insurance in that liability coverage only pays for damages to others if you are at fault in an accident, while full coverage also includes protection for your own vehicle.

Understanding Full Coverage Insurance Quotes

When it comes to full coverage insurance quotes, it's essential to understand the breakdown of the components that make up the quote. Factors such as age, driving history, and vehicle make and model play a significant role in determining the final cost of your insurance policy.

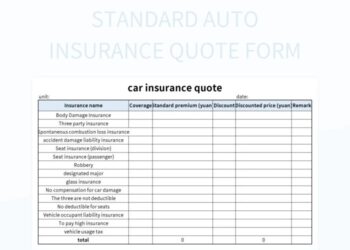

Components of a Full Coverage Insurance Quote

Full coverage insurance quotes typically include several components that contribute to the overall cost of the policy. These may include:

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

- Personal injury protection

Factors Impacting the Quote

Factors such as age, driving history, and the vehicle make and model can have a significant impact on the cost of your full coverage insurance quote. Younger drivers or those with a history of accidents may face higher premiums, while older drivers with a clean record may enjoy lower rates.

Additionally, the type of vehicle you drive can also influence the cost, as more expensive or high-performance cars may require higher coverage limits.

Comparing Quotes from Different Providers

It's essential to shop around and compare quotes from different insurance providers to find the best deal for your full coverage insurance. Each provider may offer different rates based on their underwriting criteria, so getting multiple quotes can help you save money and find the coverage that best suits your needs.

Factors Influencing Insurance Quotes

When it comes to determining insurance quotes, several factors come into play. These factors can vary from personal details to specific coverage options, all of which can affect the overall cost of your insurance policy.

Personal Factors Impacting Insurance Quotes

- Your age, gender, and location are key factors that influence your insurance quotes. Younger drivers typically face higher premiums due to their lack of driving experience, while males may be charged more than females based on statistical data. Additionally, where you live can impact your rates, as urban areas tend to have higher rates of accidents and theft, leading to increased premiums.

Coverage Options and Policy Details

- The type of coverage you choose, deductible amount, and coverage limits all play a role in determining your insurance quote. Opting for comprehensive coverage with lower deductibles and higher limits will result in a higher premium, while choosing basic coverage with higher deductibles can lower your costs.

Clean Driving Record for Lower Quotes

- Having a clean driving record can significantly impact your insurance quotes. Insurance companies consider your driving history when calculating your premium, so a history free of accidents and traffic violations can lead to lower rates. Safe drivers are viewed as lower risk, making them eligible for discounts and reduced premiums.

Tips for Getting the Best Full Coverage Insurance Quote

When it comes to getting the best full coverage insurance quote, there are several strategies you can employ to lower your premiums without sacrificing coverage. From bundling policies to improving your driving habits, these tips can help you secure the most competitive rates possible.

Importance of Bundling Policies

One effective way to lower your full coverage insurance quote is by bundling multiple policies with the same insurance provider. This could include combining your auto insurance with your home or renters insurance. By bundling policies, insurance companies often offer discounts, resulting in overall savings on your premiums.

Improving Driving Habits for Better Quotes

Insurance companies often take into account your driving habits when determining your full coverage insurance quote. By practicing safe driving behaviors such as obeying speed limits, avoiding distractions, and maintaining a clean driving record, you can demonstrate to insurers that you are a responsible driver.

This can lead to better quotes and potentially lower premiums.

Closure

In conclusion, understanding Full Coverage Insurance Quotes is key to safeguarding your vehicle and yourself on the road. With the right knowledge and approach, you can navigate the complex world of insurance quotes with confidence and clarity.

Question Bank

Why is full coverage insurance important?

Full coverage insurance provides comprehensive protection for your vehicle in various situations, giving you peace of mind on the road.

How do personal factors influence insurance quotes?

Factors like age, gender, and location can impact insurance quotes, as insurance providers assess risk based on these details.

What are tips for getting the best full coverage insurance quote?

Strategies like bundling policies, maintaining a clean driving record, and improving driving habits can help you secure the best insurance quote without compromising coverage.

![The [Ultimate 2025 Guide] To Public Liability Insurance In Dubai](https://consul.infotangerang.id/wp-content/uploads/2025/11/New-Rules-for-Premium-Payments-in-Insurance-120x86.png)